Retirement entails numerous changes. Your income may decline, and your lifestyle may also change. The large house in which you raised your children may no longer meet your needs or finances.

Assessing Retirement Housing Alternatives

If you’re a senior looking to relocate, here are seven possibilities to consider:

- Assisted living.

- Relocating with the children.

- Collaborative housing.

- Communities of self-sufficient residents.

- Assisted living facilities.

- Communities with a life plan.

- Housing that is subsidized.

Assisted Aging in Place

Decide whether you truly want to start over somewhere fresh before you sell your house. Many homes may be made safe and comfortable for retirees with a few modifications, such as moving a bedroom on the main floor and putting grab bars in the bathroom.

Aging in place, is a feasible living arrangement only for some any senior. Sure, personal care assistants provide services such as cooking, cleaning, and errand running. Some services may be able to supply therapists and nurses to aid with medication or other hands-on needs for persons who require expert care. But in general, retirees, do not want to stay living in the same place

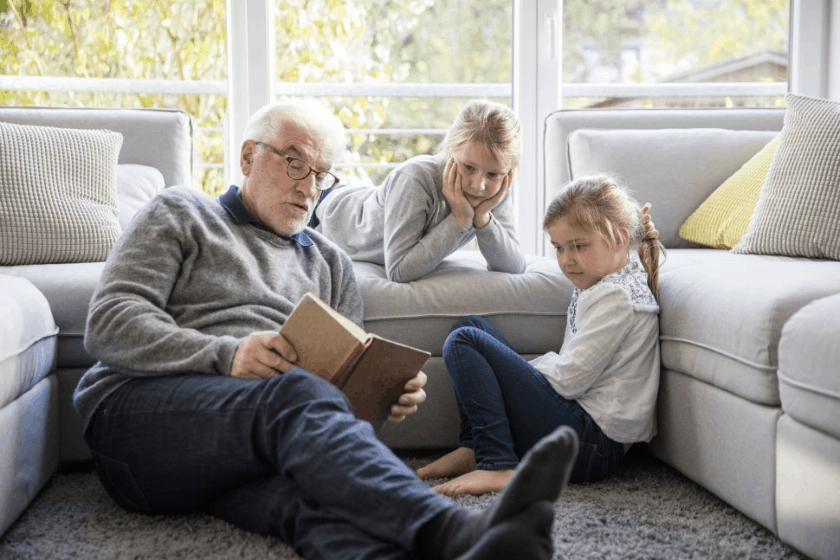

Relocating with the Children

While moving in with an adult child – or having them move in with you – is also not for everyone, it can be a win-win situation. It has the potential to immediately halve living expenses. Additionally, both parties may benefit from fringe benefits. Busy parents may find themselves with built-in babysitting, while seniors, particularly single seniors, benefit from a busy household that combats loneliness and the associated health risks.

The key to ensuring the success of these arrangements is to establish clear parameters from the start. Ascertain that everyone is on the same page regarding community living, personal space, and bill sharing.

Collaborative Housing

If you choose not to live with a family member, try co-housing with another senior. Home sharing with another retiree gives comparable financial benefits without the complications associated with moving in with the children.

Seniors who still own their homes may find that a housemate pays a significant portion of their living expenditures, while renters may find that their monthly bills are cut in half.

Communities of Independent Living

Independent living communities are referred to by a variety of different terms. These communities are sometimes referred to as retirement villages, active adult communities, or senior housing. Residents have their own private living area while also having access to on-site activities such as theaters, golf courses, and restaurants. Residents may also be offered planned social events and excursions.

While retirement communities are sometimes associated with huge suburban projects, seniors can also choose to remain in cities. “In general, you’re seeing some repurposing of buildings, refurbishment of old schools, hospitals, and other city sites into new senior housing is a possibility. While some developments cater to a more affluent customer, Pomeranz observes a tendency toward creating living spaces that cater to the middle market.

Assisted Living Facilities

For those who require assistance with daily activities, assisted living may be the best option. Individual apartments may be included in these properties, as well as community areas for dining and other events. Staff members may assist with a variety of housekeeping, personal hygiene, and medication reminder chores.

Assisted living care is frequently used as a transition from independent living to nursing facility care. It is designed for individuals who are capable of managing numerous things independently and do not require extensive 24-hour help.

According to the 2019 Genworth Cost of Care Survey, the national median cost of assisted living is $4,051 per month in the US . Certain institutions may charge an entrance fee, while others may charge a monthly cost that includes food and utilities. While Medicare does not cover assisted living, long-term care insurance may.

Communities with a Life Plan

At first glance, a Life Plan Community may appear to be an unaffordable housing alternative for many seniors. Certainly, it is not a choice for anyone who does not have a substantial sum of cash on hand to pay the initial entrance price. For those who may require expert nursing care in the future, however, a Life Plan Community may be a more inexpensive option in the long run.

Life Plan Communities include multiple types of housing on a single site, allowing seniors to transition from independent living to assisted living and then to skilled nursing care as needed. Certain communities are all-inclusive, providing meals in addition to other activities.

While these communities provide a variety of contract alternatives, the top level often ensures care at a set charge. If a resident’s financial situation deteriorates to the point where they can no longer afford the charge, several communities have foundations or aid programs in place to cover the cost. Pomeranz cautions, however, that “a for-profit (community) is not often willing to make that commitment.” Because contracts and services differ, thoroughly read the fine print before signing.

Housing Subsidies

There are a variety of housing programs available to assist seniors with subsidized or stabilized rentals. There are also a variety of other programs available at the state and city levels, however, navigating subsidized housing programs at all levels can be challenging. Each organization may have its own set of eligibility requirements and application process. “Systems can be complex and intimidating,”

Even if you believe you will not want subsidized housing for years, begin applying immediately, as the majority of programs do have waiting lists,” she advises. Retirement entails numerous changes. Your income may decline, and your lifestyle may also change. The large house in which you raised your children may no longer meet your needs or finances.